- HAMILTON Training Center

- Detailed information

>> About Hamilton's VENUS Software

Are you using a different VENUS version? No problem, VENUS 6 is not much different from older versions! So you will also learn how to work with older versions if you attend a VENUS 6 training course.

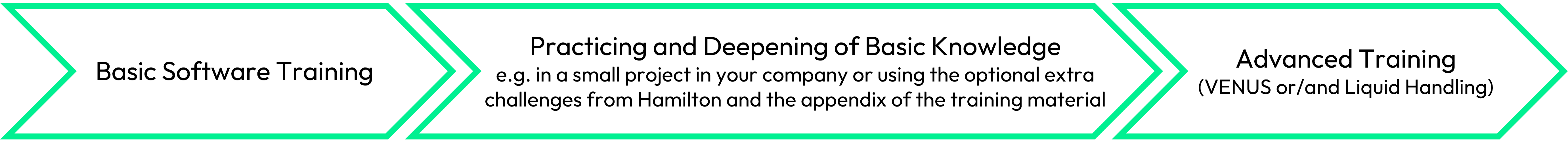

Your learning phases

Invoicing procedure: Local Currency and VAT

Value Added Tax (VAT) is a consumption tax that is applied to nearly all goods and services such as trainings that are bought and sold for use or consumption in the specific country. There are standard rules on VAT, but these rules may be applied differently in each country. VAT is charged where the services are performed (place of supply; not applied for Online Trainings).Please note that you need to agree to receive the invoice for your training course place from the Hamilton entity that is delivering the training to comply with the country-specific rules on VAT.

If this is not acceptable, please register for a course that is in the same country as you are located. Depending on the Hamilton entity and the local rules on VAT, the currency quoted may be the local currency or your own currency. Please contact our Hamilton Training Team in advance if the currency quoted needs to be your own currency.